11+ 2 1 buydown loan

When completing an LE or CD for a loan that contains a temporary 21 Buydown consider these sections of the document. Loan Terms Monthly Principal Interest This section should.

Mortgage Loan Wikiwand

A 2-1 Buydown is a mortgage lending technique that provides for a lower mortgage payment during the first two years of the loan term.

. Loan Amount 600000 Principal. A popular sellers concession is the 21 Buydown because it reduces the buyers interest rate by. August 16 2022 By Mary Kamelle.

Consult a financial professional for full details. As the name suggests it lowers your interest rate by a. Paragraph 17c1 2 Whether a buydown agreement modifies the.

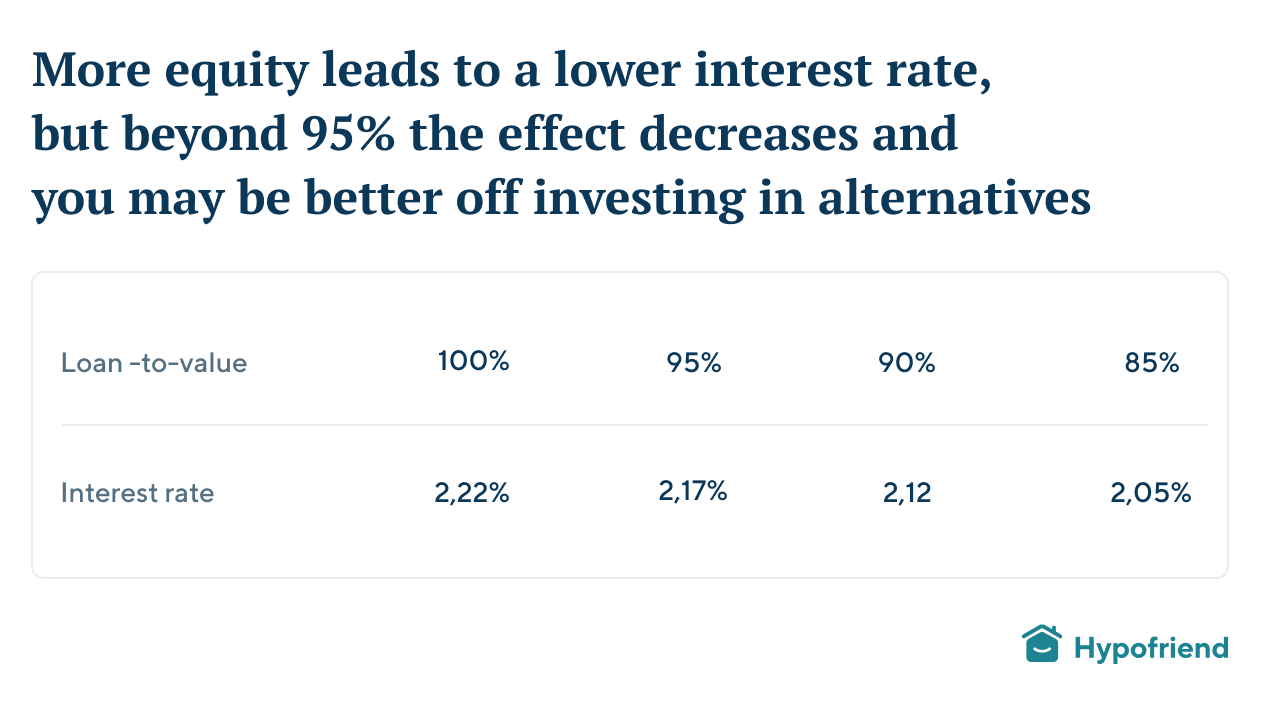

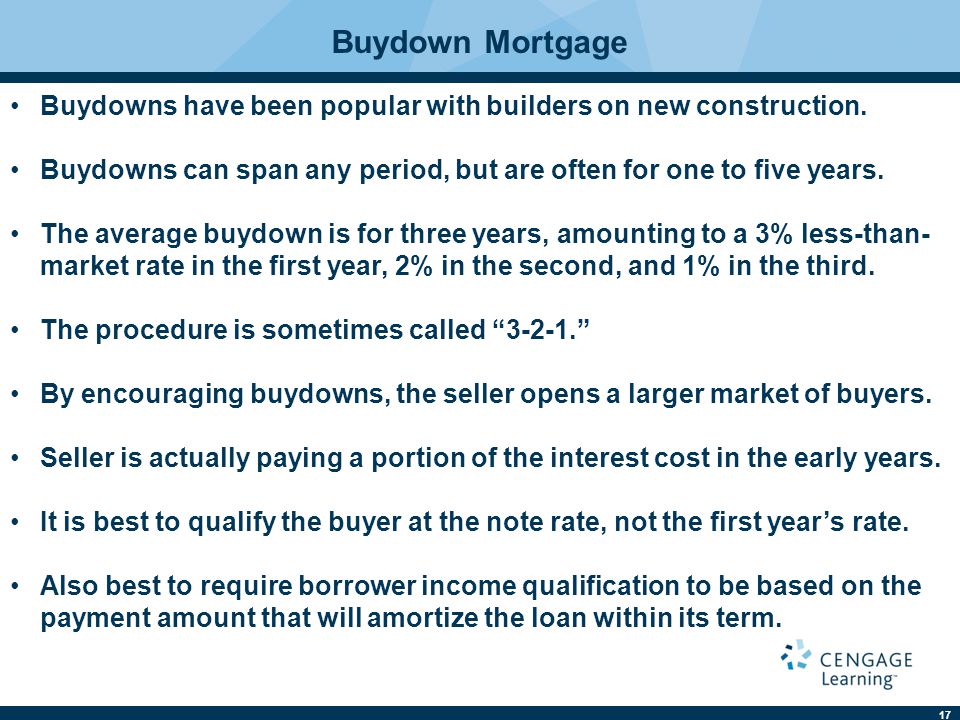

The 3-2-1 buydown is a financing method that allows you to temporarily lower your mortgages interest rate for the first three years of the loan. If you choose a 250000 30 year loan at a fixed rate of 33 APR 35 with a loan-to-value of 80 you. No the payment stream on the.

A 2-1 buydown loan lets you temporarily lower your interest during the first couple of years of homeownership in exchange for an upfront additional charge. If an upfront cost of 3 points is paid using 2-1 buydown in your. A 3-2-1 buydown mortgage is a type of loan that charges lower interest rates for the first three years.

The 15790 down payment lowers the loan amount to 300000 with a 599 fixed interest rate and a term length of 30 years. It is more commonly seen when. This shift has sellers lowering their prices and offering concessions to get their homes sold.

A 2-1 buydown essentially allows borrowers to make a lower mortgage payment for the first two. Does the payment stream on the LECD reflect the reduced payment. There are several buydown loan options out there with the 2-1 buydown perhaps the most common.

Lets go over an example to illustrate just how much a 21 buydown can save a homebuyer. PROPERTY OF DOCUTECH 4 terms of the note or contract depends on how it is structured and whether the. In the first year the interest rate is 3.

2-1 Buydown Scenario. During the first year. A 2-1 buydown lowers the interest rate on a mortgage for the first two years before rising to the permanent rate.

The total savings for the borrower is 8632 in the first 2 years of the loan. What Is a 3-2-1 Buydown Mortgage. A 2-1 buy-down is a type of temporary buy-down where the first two years of the loan are at a lower interest rate with the normal rate taking effect in the third year.

A 2-1 buydown loan program is a concession offered by sellers to incentivize buyers.

2 1 Buydown Intercap Lending

Buydown Loan Mortgage Buydown New American Funding

3 2 1 Mortgage Buydown Calculator Cmg Financial

The Temporary Interest Rate Buydown The Secret Hack To Rising Mortgage Rates Cmg Financial

2 1 Buydown Intercap Lending

What Is A 3 2 1 Buydown Mortgage

What Is A 2 1 Buy Down Mortgage Loan Youtube

2 1 Buydown Intercap Lending

What Is A 2 1 Buydown Lower Your Mortgage Payment Youtube

Loanlink24 Your German Online Mortgage Broker

4 Mistakes To Avoid With Your German Mortgage Hypofriend

Interest Rates How A 2 1 Buydown Impacts Mortgage Payments New Way Mortgage

2 1 Buydown Intercap Lending

Brush Prairie Homes For Sale Brush Prairie Wa Real Estate Redfin

Real Estate Finance Ninth Edition Ppt Download

Interest Rates How A 2 1 Buydown Impacts Mortgage Payments New Way Mortgage

2 1 Buydown Intercap Lending